When you have a problem from a brand or service provider, the best course of action these days to get a resolution is reach out to them on social media. As with previous versions of customer service, the social media-driven option still yields mixed results, as a recent report from research firm BrandsEye points out.

Looking specifically at South Africa’s financial institutions and their ability to deliver solid customer service, the report looks at overall net sentiment regarding local banks, with BrandsEye combing through 2.7 million social media posts between 1st September 2020 to 31st August 2021.

One of the most notable findings from the report, is that banks that failed to innovate and improve in terms of service delivery, were quickly overtaken by their competitors in this space.

“Advancing in the Index ranks proved more difficult than declining this year,” explains BrandsEye Business Development director, Lyndsey Duff in a press release for the report.

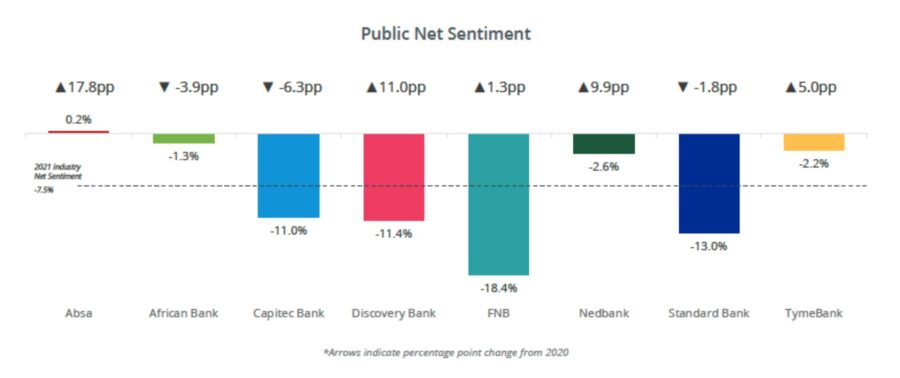

“Absa, Nedbank, and Discovery Bank all surpassed Standard Bank, despite the latter only declining by 1.8 percentage points in public Net Sentiment,” she illustrates.

This is the sixth year that BrandsEye has produced this report, and over the past 12 months, it is ABSA that has seen the most improvements as far as net sentiment is concerned, increasing by 0.2 percent as the above graph shows.

While that is good news for ABSA, the financial institutions as a group did not fare well, with an overall negative sentiment of -7.5 percent. That said, BrandsEye notes that the outlook moving forward is looking better, with the likes of Discovery succeeding in that regard, with an operational improvement of 23.9 percentage points.

Another success story is TymeBank, which we have seen eye up new markets this year.

“The digital bank leveraged social media influencers as brand ambassadors to drive positive content, boosting reputational sentiment by 3.8 percentage points and securing third place overall in the 2021 Index rankings,” notes BrandsEye.

As for areas where significant improvement can be made, the research firm says simply answering queries posed on social media is a big first step for banks to take. To that end, a massive 57 percent of mentions went unanswered, which potentially means more time and resources should be directed at this aspect of customer service delivery.

“Banks have yet to effectively handle the growing volume of service requests on social media. Service-related conversation first spiked in 2020 as a result of COVID-19, but has continued to increase throughout 2021,” highlights Duff.

The director also points out that failure to address mentions on social media could pose additional risks in terms of falling foul with regulators.

“When mapping the social media conversation according to the six Treating Customers Fairly (TCF) outcomes prescribed by the FSCA, we discovered that 50.1% of sentiment-bearing conversation contained a conduct theme,” says Duff.

“With the Conduct Standard for Banks having come into full effect from July of this year, South African banks are required to enforce the TCF principles across multiple areas of market conduct, or risk facing hefty fines,” she concludes.

As such, in 2022, social media should not simply be used as a channel to advertise or share old memes by banks, but also a tool to deliver better customer service.

To download and read the latest BrandsEye report for yourself, head here.

[Image – Photo by Collins Lesulie on Unsplash]