One can’t say that Netflix had a bad final quarter of 2021 given the firm walked away from it with $7.7 billion in revenue.

Even when looking at the number of new subscribers things aren’t bad. Globally Netflix saw 8.28 million new subscribers joining the service during the quarter bringing the total number of subscribers to 221.84 million members.

This is all looks great, if you aren’t a Netflix investor and you’re obsessed with “paid net adds”, their term for paying new subscribers.

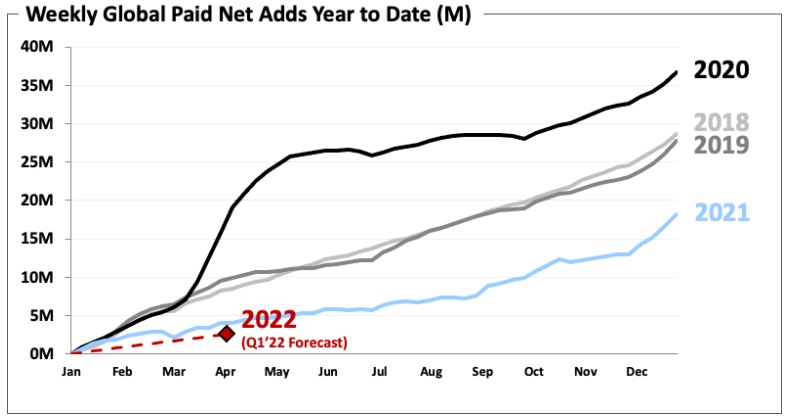

Netflix forecasted that paid net adds in Q4 would total 8.5 million but fell short in actuality with just 8.3 million net adds. In fact, for the year, the total net paid adds amounted to 18 million versus 37 million in 2020. It’s important to remember that 2020 was an anomaly of a year for Netflix and many other firms but this is still a massive gap between years and Netflix isn’t forecasting an improvement.

“For Q1’22, we forecast paid net adds of 2.5m vs. 4.0m in the year ago quarter. Our guidance reflects a more back-end weighted content slate in Q1’22. In addition, while retention and engagement remain healthy, acquisition growth has not yet re-accelerated to pre-Covid levels. We think this may be due to several factors including the ongoing Covid overhang and macro-economic hardship in several parts of the world like LATAM,” Netflix said in a statement to investors(PDF).

With all of this in mind, it makes sense then that Netflix’s share value fell 20 percent in after-hours trading.

While it can’t be denied that Netflix has content that attracts new subscribers, the same could be said for any streaming platform you throw a dart at.

The firm is of the opinion that its growth outside of the US and Canada will help offset the slowed growth. However, that growth is also costing Netflix.

“With ~60% of our revenue outside of the US due to our international success, we estimate that the US dollar’s appreciation over the past six months has cost us roughly $1 billion in expected 2022 revenue,” the firm said. “With the vast majority of our expenses in US dollars, this translates into an estimated two percentage point negative impact on our 2022 operating margin.”

This all presents an opportunity for other streaming platforms to capitalise on although this raises questions about the long-term performance of streaming. Netflix is the biggest streaming platform in the world and, while it only went global in 2016, it’s clear the firm is struggling to keep up the monumental growth it has seen since then.

Whether a push into gaming will help lure more subscribers in remains to be seen but we’re not especially confident and seemingly neither are investors.