With Elon Musk now set to become the owner of Twitter and take the firm private, all eyes are on the social network’s financials over the first quarter and, there is good news to be found.

Looking at revenue for starters, Twitter reports that it drew in $1.2 billion in revenue for the quarter and increase of 16 percent year on year. The majority of that revenue comes from advertising which drew in $1.11 billion (a 23 percent increase year-on-year) while subscription and other revenue totaled $94 million.

Net incomes for the quarter amounted to $513 million.

“Net income of $513 million includes a pre-tax gain of $970 million from the sale of MoPub for $1.05 billion and income taxes related to the gain of $331 million. This compares to net income of $68 million, a net margin of 7 percent and diluted EPS [earnings per share] of $0.08 in the same period of the previous year,” Twitter told investors.

As regards users, much like other US-based social networks, growth has some what plateaued with average monetisable daily active users (mDAUs) in the US only growing 6.4 percent to 39.6 million.

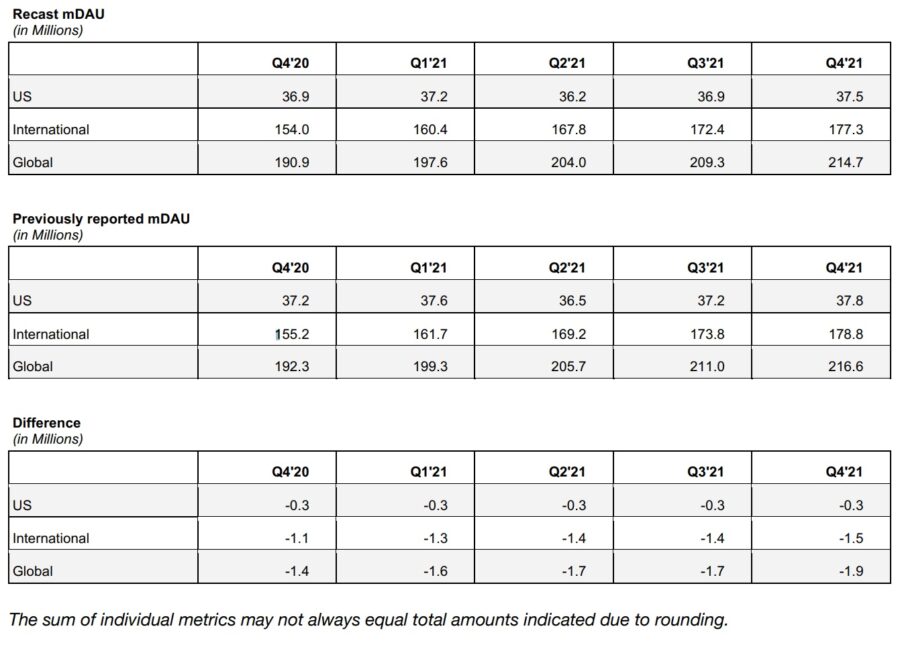

However globally, Twitter was monetisable daily active users grow 18.1 percent to 198.4 million. The firm also corrected past reporting for monetisable daily active users.

“In March of 2019, we launched a feature that allowed people to link multiple separate accounts together in order to conveniently switch between accounts. An error was made at that time, such that actions taken via the primary account resulted in all linked accounts being counted as mDAU. This resulted in an overstatement of mDAU from Q1’19 through Q4’21,” the firm wrote.

At the top end this lead to 1.9 million users who were counted as another user when taking action on one of multiple accounts they operate. This is bad and we’re sure that investors will be having stern words with management, but more so it reflects just how slow Twitter’s growth has been over the past two years.

The social media platform isn’t hosting a conference call, providing forward looking statements or issuing a letter to shareholders. The reason for this is due to Musk’s pending deal to acquire the firm.

While the deal is subject to customary closing conditions, the completion of regulatory review, as well as stockholder approval, Twitter won’t be releasing anything for the foreseeable future. That said, the firm does expect the deal will close this year.

This could likely be the last time we see financial data from Twitter as, if Musk’s acquisition be successful and he takes the firm private before the next quarter, there would be no need to publish financial statements.

That having been said, “if” is doing a lot of heavy lifting there as it looks like barring government intervention, the new owner of one of the largest social media firms, is this guy:

Next I’m buying Coca-Cola to put the cocaine back in

— Elon Musk (@elonmusk) April 28, 2022

The future sure does look interesting.