- This week a new instant payment service called PayShap launched in South Africa, with it being utilised by nearly all major financial institutions.

- The service allows you to make payments between different banks instantly without the need to share banking details.

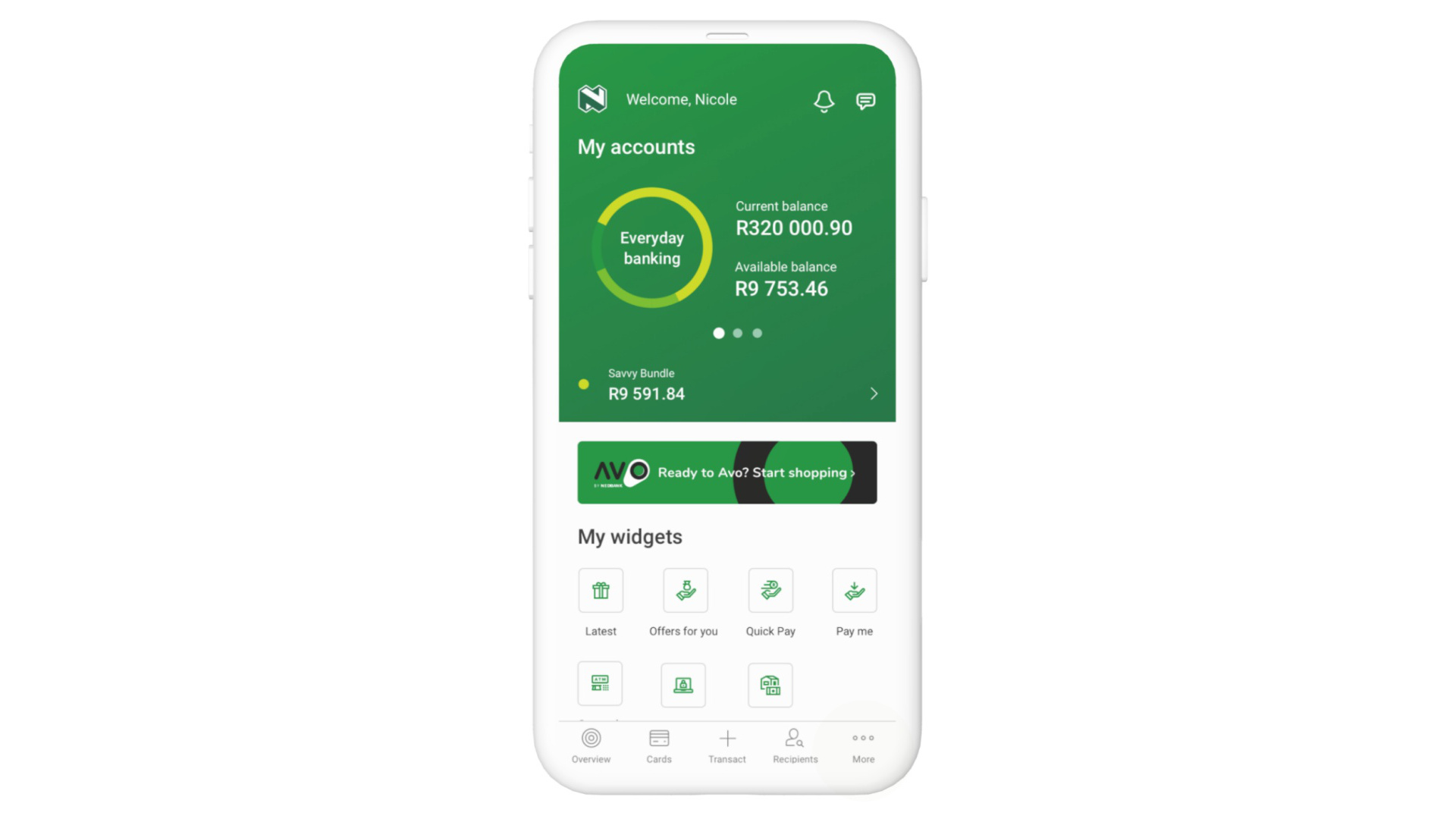

- To incentivise its use, Nedbank is making the service free to use on its platforms until the end of April.

If you are a South African bank account holder, you’re likely hearing all about PayShap. It is a new instant payment service that makes transacting between different financial institutions quicker and easier by essentially removing the need to share banking details.

Currently Absa, FNB, Nedbank, and Standard Bank are signed up for its use, with PayShap being part of a wider industry collaboration led by BankServAfrica.

In order to incentivise its use, Nedbank is making PayShap free to use on its platform from now until 30th April. The financial institution confirmed in a press release sent to Hypertext that a nominal fee of R1 on transactions will be applied thereafter.

“We are pricing PayShap aggressively because we strongly believe that it is an innovation with enormous potential to help more South Africans join the digital economy. By enabling individuals and small businesses to make instant payments cost-effectively using their mobile phones, PayShap offers the security of digital transacting with the immediacy of cash,” noted Nedbank managing executive for Solution Innovation, Dayalan Govender.

Looking a bit closer at the solution, it allows users to transact instantly without sharing banking details or using a banking app. Instead, instant messaging applications like WhatsApp will be used to transfer funds using a proxy (such as a cellphone number) for each party’s bank account or e-wallet. Nedbank says it aims to help eliminate the need for cash to pay smaller businesses or to exchange funds with friends or family members.

“It aligns perfectly with Nedbank’s long-held belief that digital technology has a vital role to play in helping South Africans transact more easily, safely and cost-effectively,” he added.

You can watch personal finance columnist Maya Fischer-French speak to ENCA about PayShap in the video below, explaining why the solution is a potentially revolutionary one for the South African banking industry.