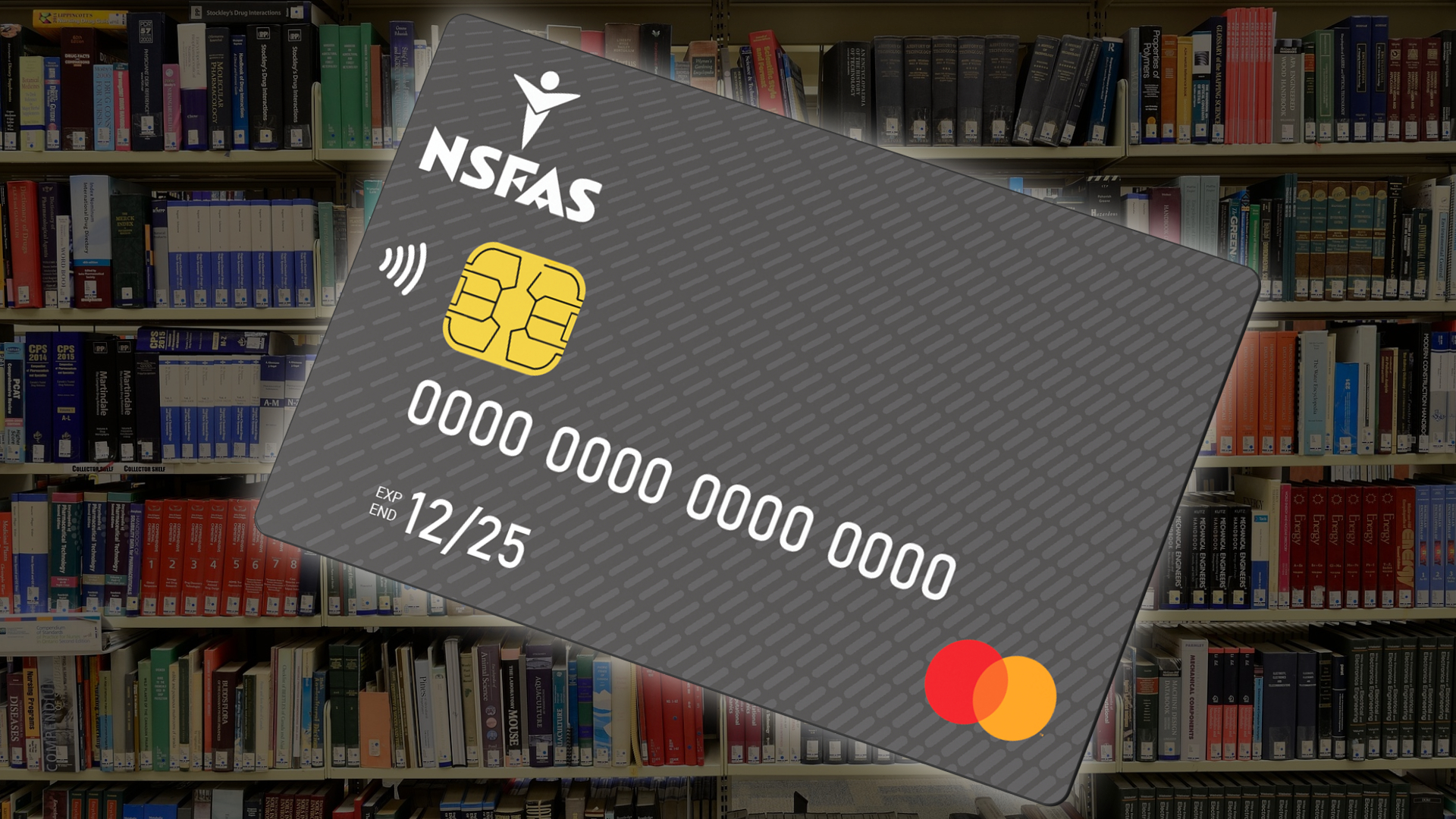

- NSFAS has begun the rollout of new bank accounts and cards with the help of several partners, including Mastercard.

- The new bank accounts will soon become the method for all the scheme’s beneficiaries to access their allowances.

- Banking cards will also be distributed that give beneficiaries more financial freedoms, including the ability to make online payments and use ‘Tap to Pay’ at the till.

To make it easier for student beneficiaries to access their funds, the National Student Financial Aid Scheme (NSFAS) has partnered with several fintech firms to launch NSFAS Student Bank Accounts.

The new bank accounts, which can be signed up for here, will allow the nearly 1 million beneficiaries of the scheme to access allowances and transact through new Mastercard-backed bank cards. They were first announced in February, and it seems now university students are starting to receive their cards.

According to NSFAS, the new payment solution will seek to alleviate some of the challenges of the current allowance payment method, as well as cater for the ever-increasing number of beneficiaries the scheme takes in every year.

Unfortunately, not every beneficiary will be able to receive, access and begin using a NSFAS bank account and card as the rollout of accounts will follow a phased-in approach.

“With the estimated number of NSFAS funded students at 900 000, not all these students will be onboarded onto the new payment system immediately, NSFAS will pilot this solution with a set number of students first, following which the full roll-out will occur,” the scheme explains.

However, “In the end, all NSFAS funded students should receive their allowances and transact through the NSFAS Bank Account.” So it seems not only will this method be introduced to help NSFAS students, but it will also replace the previous allowance method.

There are a host of benefits that the new accounts and cards will bring to students, all-centred around improved financial freedoms. These include:

- “Access to new value-added services,

- more banking freedom,

- ability to make online purchases and transactions,

- the use of a new partner mobile app for the use of EFT transactions,

- ‘Tap to Pay’ functionality,

- and SMS notifications for any transactions.”

So it seems that the NSFAS cards will be fully-fledged bank cards, similar to cheque account cards. Students with the cards will be able to order food online, use EFT to make payments, access and control their allowances through an app and use tap to pay at the till.

Students will also be issued a virtual and physical bank card, have access to a call centre for queries and will be able to capture and update their personal details at will. The cards will be PIN protected, and will “afford beneficiaries control over their finances and teach them financial responsibility.”

The scheme has tapped four partners for the roll-out of the new accounts and cards, namely Coinvest Africa, eZaga, Narraco, and Tenet Technology. These partners will aid the scheme in different portions of the rollout.

For example, eZaga and Tenet Technology will help out with the onboarding of educational institutions, which already include Durban University of Technology, the University of Free State, the University of Limpopo, the University of Pretoria and others.

Meanwhile, Coinvest is handling student onboarding.

🎉Join your peers who are excited about the convenience of having a #NSFASbankcard. How excited are you?#NSFAS #studentlife #bankcard #excitement pic.twitter.com/Hmyy9G9fSu

— NSFAS (@myNSFAS) May 9, 2023

If you are an NSFAS beneficiary, you can sign up for a chance to be part of the initial roll-out here.

The scheme, funded by the government, distributes enormous amounts of money every year to students in need of an education. In February, NSFAS spent R6.2 billion just to get its beneficiaries started for the academic year.

However, with the vast amounts of funds that move between itself and institutions, NSFAS has come under the magnifying glass in recent weeks as South Africa’s corruption-busting watchdog sniffs out alleged illicit spending activity and incorrectly allocated monies to the tune of R5 billion.