- The Organisation Undoing Tax Abuse (OUTA) has found that NSFAS hired fintech partners that were unlicensed to provide banking services for its new student bank accounts.

- On top of this, these bank accounts ask for fees far higher than the norm when compared to South Africa’s big four banks.

- NSFAS beneficiaries, nearly 1 million, were forced to use these bank accounts to access their allowances from 1st July 2023.

After widely launching its bank accounts and Mastercard-branded bank cards on 1st July 2023, the National Student Financial Aid Scheme (NSFAS) has come under fire from beneficiaries and student organisations who claim that the newly imposed banking fees associated with the accounts are unfair.

South Africa’s Organisation Undoing Tax Abuse (OUTA) has been investigating alleged dodgy dealings at the scheme since 2022, and now says that it has been expecting the situation that is playing out.

NSFAS is a government-funded and operated institution that grants financial support to vulnerable tertiary education students at universities or TVET colleges and has doled out billions of Rands in scholarships and other education-associated monies to nearly 1 million young people this year.

“OUTA has been outspokenly against this since we first heard of this payment scheme. Just another ‘eating’ opportunity for connected cadres,” the independent consumer protector says via a Twitter post.

We agree with you. #OUTA has been outspokenly against this since we first heard of this payment scheme. Just another "eating" opportunity for connected cadres. We believe as much as R1.5 billion will go towards this card payment scheme. How many students can study with that? https://t.co/H3O1BCnl8z

— OUTA (@OUTASA) July 3, 2023

It says it has been investigating NSFAS tender deals for a few years now, and that it believes that as much as R1.5 billion in taxpayer money will go towards this card payment scheme.

In its findings, collated on its website, OUTA alleges that most of the fintech partners hired by NSFAS – eZaga, Coinvest, Narroco and Tenetech – do not have banking licenses or VAT registrations to make direct payment of student allowances.

What’s worse, is that a banking license or affiliation with a bank was supposed to be a compulsory bid requirement. This seems to have been flouted. Only eZaga Holdings has an affiliated banking license with Access Bank.

NSFAS beneficiaries were forced to use the new bank account system to receive their allowances as of 1st July and have had to sign up with the scheme’s banking partners and use their applications to access their funding, which includes accommodation funds and living expenses.

The contract for these companies spans the length of five years, and OUTA believes it is worth at least R1.5 billion. The four companies that won the contract, listed above, are relatively new, with the oldest one being eZaga Holdings, registered in 2017 and the youngest one being Tenet Technology (registered in 2013 but dormant until 2021).

These four newcomers also managed to beat out huge established South African companies – Standard Bank, Absa, FNB, and even MTN – for the tender.

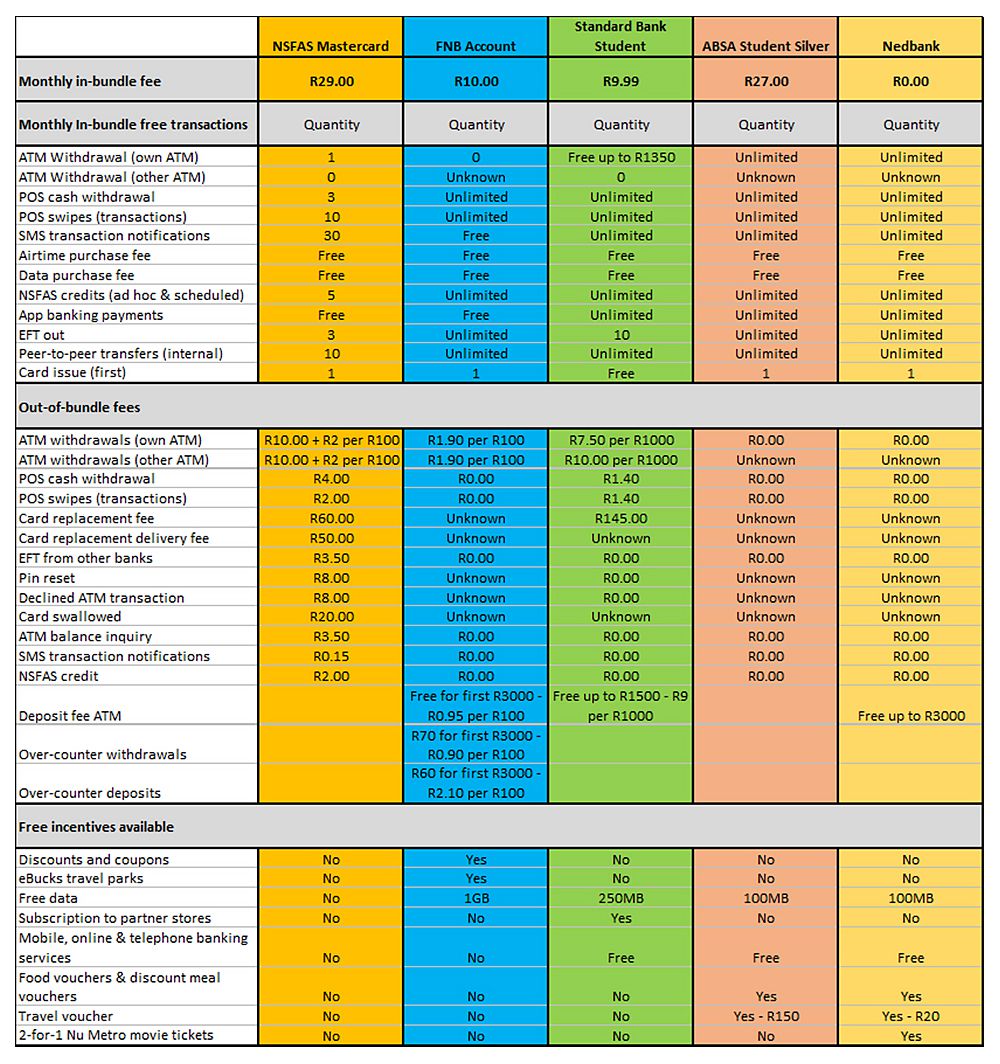

OUTA has also compared the fees NSFAS beneficiaries will have to pay to fees that South Africa’s big four banks charge, and has found that, overall, NSFAS beneficiaries are being made to pay more.

“OUTA found that most commercial banks in South Africa offer accounts for students with low banking fees and costs and more value-added services than the approved service providers,” it says.

Specifically, the ATM withdrawal charges of NSFAS bank accounts are the highest when compared to established banks. Every time beneficiaries draw money they will have to pay R10 plus a further R2 for every R100 they draw. This means that if a student draws R300 they will have to pay the banking partner R16.

The closest comparison to these charges is with Standard Bank Student accounts, but even then withdrawal charges are only per R1 000 drawn. These fees add up and are especially damning as students only receive R15 000 per year from the scheme for their day-to-day living. Effectively a R41 per day wage, or a monthly stipend of R1 250, far below South Africa’s minimum wage of around R3 500 per month.

NSFAS has not made any public communications on the uproar in the academic community or among beneficiaries. Neither have they addressed the allegations. We have reached out to the scheme for comment.

OUTA says it has handed over its investigation and materials to the Special Investigation Unit (SIU), an agency that roots out corruption in the country.

[Source – OUTA]