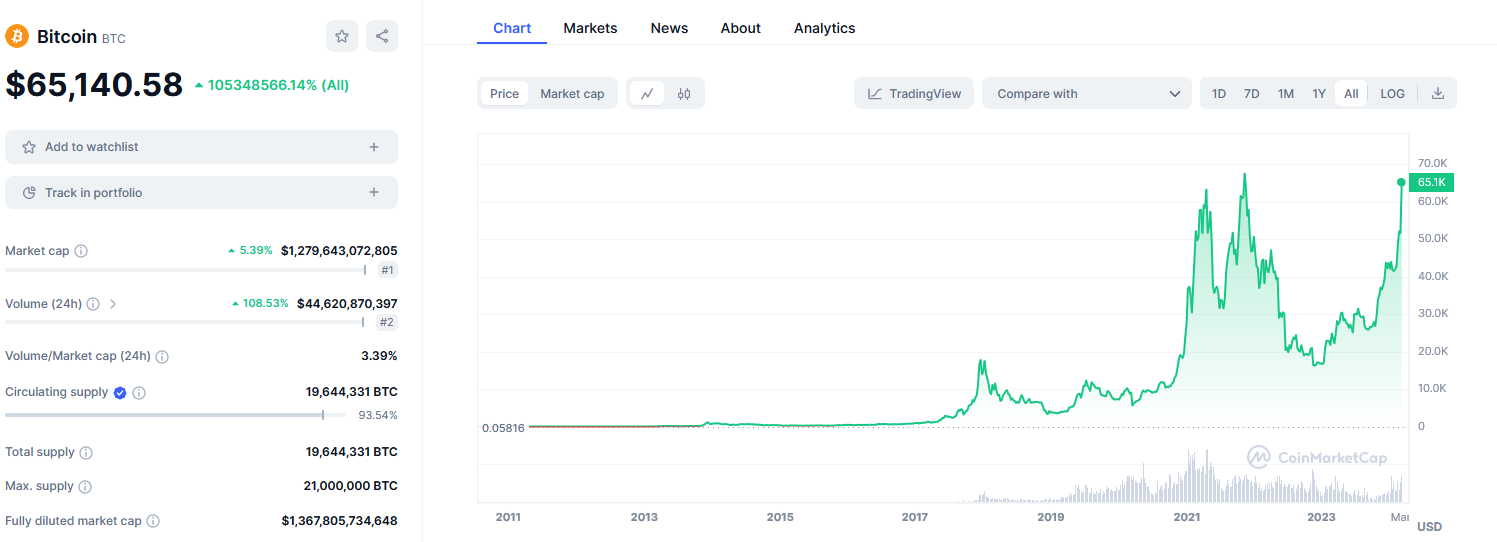

Bitcoin, the world’s leading cryptocurrency, is still gaining and is now shy of just $4 000 before hitting its all-time record price of $68 999 again. The token last touched this milestone in November 2021 and is sitting steady at around $65 000 as of the time of writing.

Its latest gains, up from $62 000, were made just over the weekend. The token gained over 50 percent its price in the last few weeks as US-listed Bitcoin funds have rocketed in popularity.

On Friday, investors were in a flurry as the embracing of Bitcoin-listed Exchange-Traded Funds and easy-to-invest crypto apps spurred a new wave of accessibility for Bitcoin, leading to renewed positive sentiment and a pump for the token’s pricing against the US Dollar.

Added to this are expectations that the price will only continue increasing into April when a “halving” event is set to take place. A “halving” is when rewards for Bitcoin mining are 50 percent lower than usual, scheduled at around every four years.

According to IG.com, “Bitcoin halvings are important events for traders because they reduce the number of new bitcoins being generated by the network. This limits the supply of new coins, so prices could rise if demand remains strong.”

“The next Bitcoin halving is anticipated in April, and historical data suggests that these events often precede substantial bull runs,” explained Nigel Green, CEO of investment advisory deVere Group, in a statement emailed to Hypertext last week.

With Bitcoin already so close to its record-high price, it is likely, barring any unforeseen events, that the token will find a new record price in 2024, after two years of being considered a throwaway amid the overall crash of cryptocurrency and the NFT market in 2022 and 2023.

Bitcoin spent most of 2022 under $30 000, touching lows of just over $16 000 in November that year. It was dealing with the fallout of the COVID-19 pandemic at that time, and renewed international regulations as well. While Bitcoin has recouped these losses and then some into 2024, the NFT market – fueled by the cryptocurrency craze – has now all but collapsed into dust.

The rapid decline in the market saw firms like Meta abandon NFTs in droves, and items like Jack Dorsey’s first tweet – originally purchased for $2.9 million – dropped in price to less than $4. NFTs are now being sold less and for lower prices than ever before.

This lightning-fast rise and thunderous fall of NFTs encapsulates the problem with cryptocurrency, and why investors should be incredibly cautious before putting any significant amount of money towards these tokens. They are far more volatile than any other solid stock and have and will continue to make people and companies financial losses – sometimes crushing ones.

Be careful of investing in Bitcoin, even if the words on the screen are saying things are going well. They may not be for long.

[Image – Photo by Kanchanara on Unsplash]