- The compute requirements for training LLMs and AI can be off-putting to businesses but software-as-a-service can assist in that regard.

- As Experian tells it, cloud-based software can open up and speed up credit applications while also lowering the risk lenders open themselves up to.

- Of course data security should be the first consideration, especially when it comes to financial and other sensitive information.

Artificial intelligence (AI) and large language models (LLMs) have started finding their place in the business world as business leaders discover how beneficial the technology can be but there is a problem.

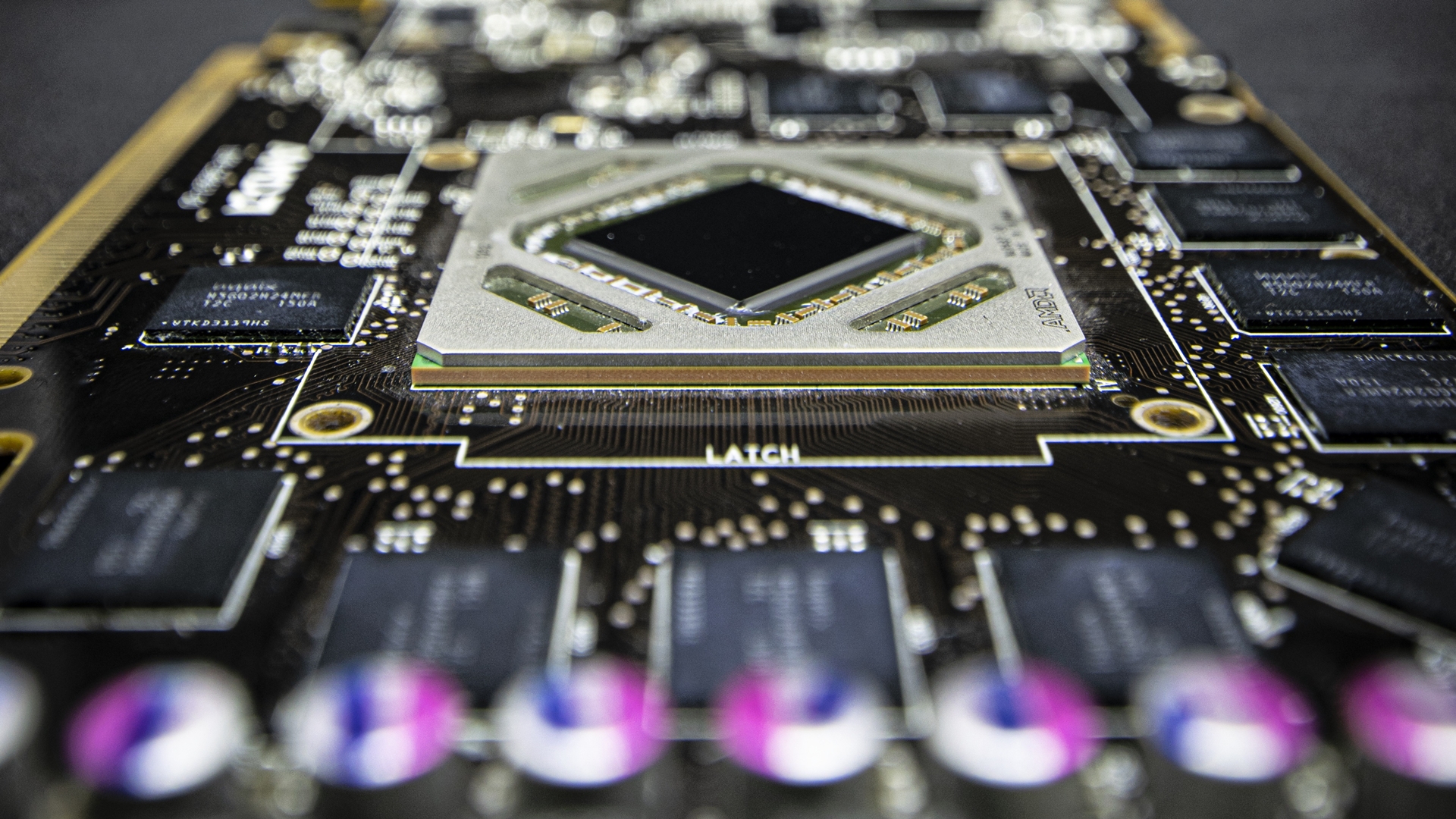

That problem is the raw compute power required to power AI and LLMs is simply untenable for most businesses outside of large multinational enterprises. Training GPT4 required 21 billion petaFLOPs (floating point operations) of computational power. For perspective, the top consumer GPUs – namely the Nvidia RTX 4090 – can hit 85 – 93 teraFLOPS of compute power. As you can deduce, one would require hundreds of thousands of GPUs to train an AI such as GPT4.

This is where software-as-a-service (SaaS) plays a key role in enabling AI integration, no matter the size of the operations. By leveraging AI and LLM solutions that live in the cloud, businesses can deliver better service to customers without needing to invest in massive GPU farms.

One area that can benefit from the capabilities of AI and LLMs is the financial sector, particularly lending.

When applying for credit, lenders need to assess multiple data points and, understandably, some data gets lost in translation. This can lead result in a lender taking on a large amount of risk if the applicant isn’t truthful or some credit agreements are stuck in limbo. More than that, if lenders don’t move fast they can lose business.

“Today’s consumers have more options and less patience than ever before. In this highly competitive landscape, we believe that high-quality digital customer experience provides a competitive advantage and our latest research explores how AI is turbocharging this process,” posits chief of decision analytics at Experian Africa, Francois Grobler.

“Our AI-powered solutions are not only helping businesses make faster and more accurate decisions but also enhancing fraud detection. We’re seeing great strides in identity verification, virtual assistance, automated onboarding, and early warning systems for vulnerable customers,” Grobler adds.

By leveraging AI, lenders can be more inclusive and products can more easily be tailored to a specific customer.

However, this means that lenders need access to platforms that can handle data coming from multiple sources, which is where AI and LLMs hosted in the cloud can help. Rather than having to parse through troves of data, AI can help spot trends, highlight risks and even identify fraud.

Furthermore, cloud-based AI and LLMs can also be scaled up or down depending on a business’ needs.

“Cloud provides the computing capacity required to ingest and manage the high volume of data that is needed for AI and ML. It provides the flexibility and scalability to enable the software capabilities needed to develop, deploy, and operate models, which ultimately integrates AI into the credit decision process,” Grobler says.

Of course, this thinking applies to other businesses as well. Utilities could leverage cloud-based AI and LLMs to offer better predictions of when demand for electricity and water may surge. Retailers could use the tech to more easily identify trends and plan for big shopping days and even explore when sales would be most effective.

As we outlined recently, however, AI and LLMs need to be properly implemented and part of that involves properly securing the data being used. While being able to quickly assess an applicant’s creditworthiness is all fine and well, that data needs to be properly protected from unauthorised access.

Cloud platforms can assist when it comes to security but ultimately, the custodian of that data is responsible for its safety.

We’re sure that many big enterprises are building their AI and LLM capabilities in-house, simply because they can. It’s good news that those who can’t can access an increasing number of applications that leverage the technology without needing to invest billions into GPU farms.