- Direct Access Finance claims to be located at Standard Bank’s Johannesburg offices, a claim the bank refutes.

- Direct Access Finance is using the NCR Registration number of Standard Bank subsidiary Blue Granite Investments No 2 but reportedly isn’t associated with that entity.

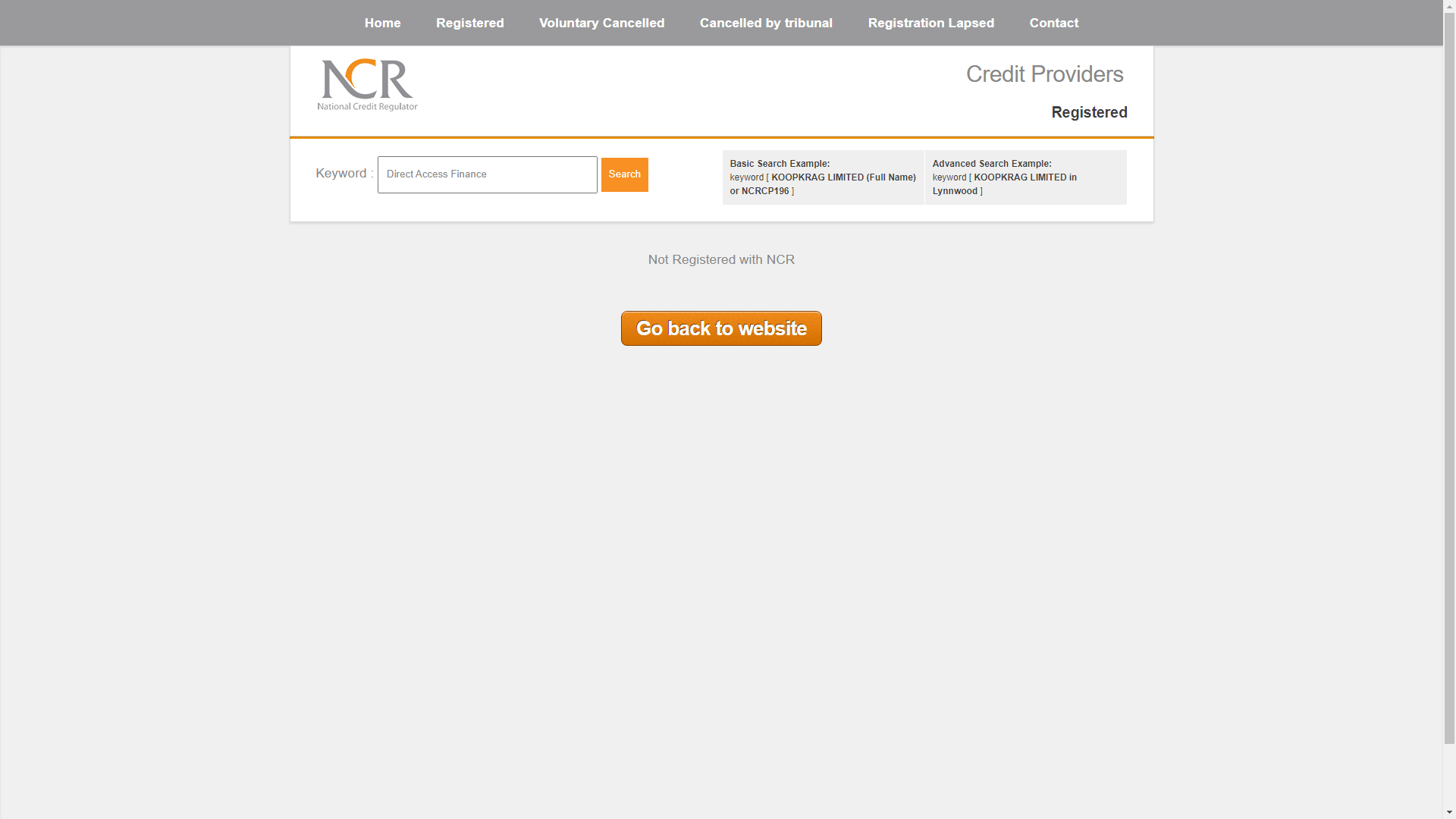

- The NCR claims that no registration for an entity with the name Direct Access Finance.

Times are tough and in those times folks may turn to loans to plug the gap between pay cheques. Unfortunately, there are some less than savoury individuals who look to take advantage of people’s desperation.

This morning, Standard Bank has issued a warning about an entity known as Direct Access Finance. This entity reportedly claims to be located at the same address as Standard Bank, 5 Simmonds Street in Johannesburg.

In addition to the address, Direct Access Finance appears to be using the National Credit Regulator (NCR) Registration number associated with Blue Granite Investments No 2. Blue Granite is a subsidiary of Standard Bank, but it and Direct Access Finance seemingly have no relation.

When searching for Direct Access Finance on the NCR’s website, the regulator reports that the entity is not registered with it.

“Standard Bank has reported the matter to the relevant regulators, and we are pursuing measures for this illegal website to be taken down. We encourage the public to always ensure that they are dealing with registered financial services providers to avoid falling victim to scams of this nature,” the financial institution said in a press statement.

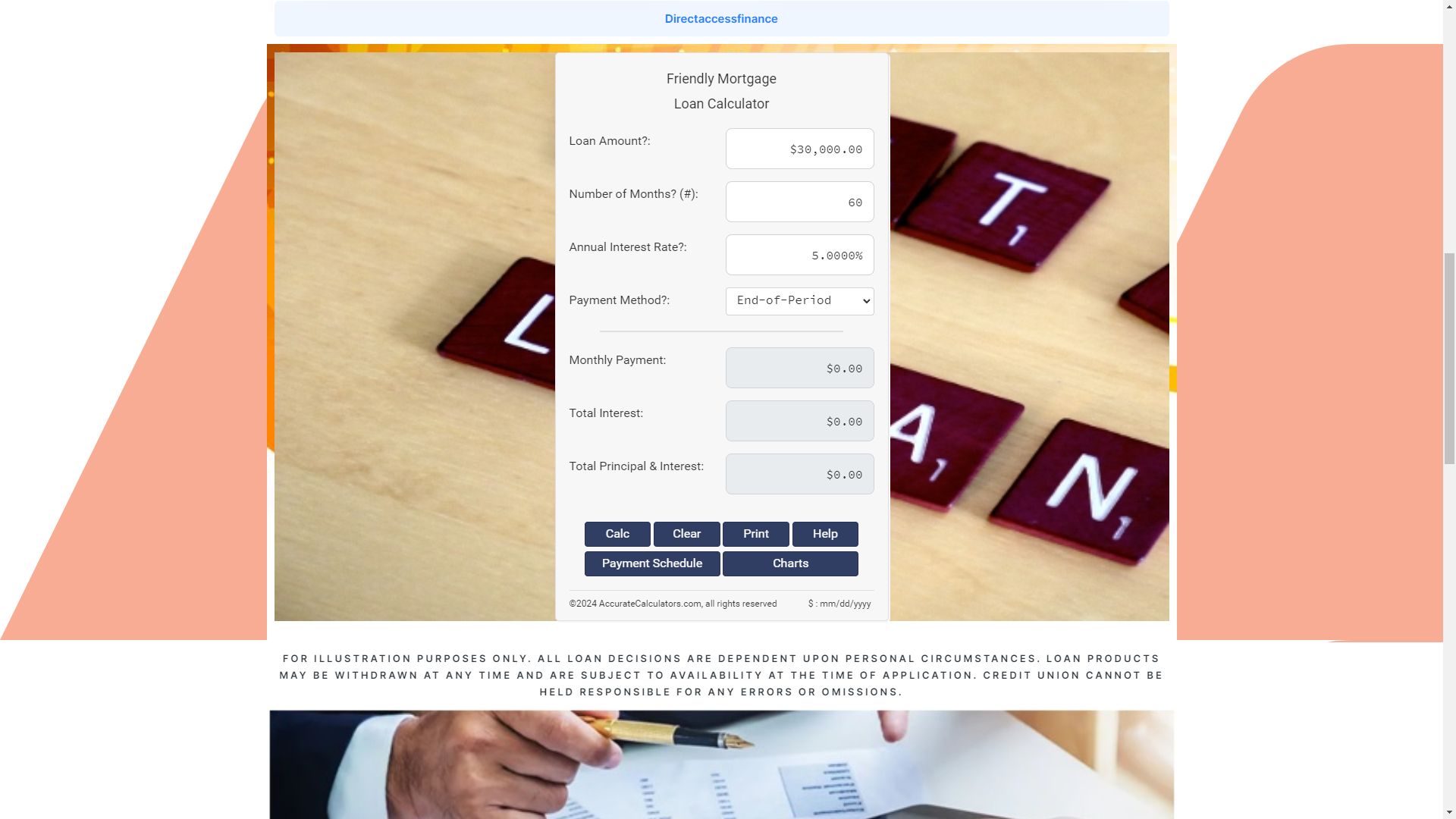

The website of Direct Access Finance is bizarre. For one the site is brimming with stock images we recognise from repositories we use here at Hypertext. The website, which again, claims to loan money to South Africans, features a mortage calculator which uses US Dollars.

But wait, it gets even stranger.

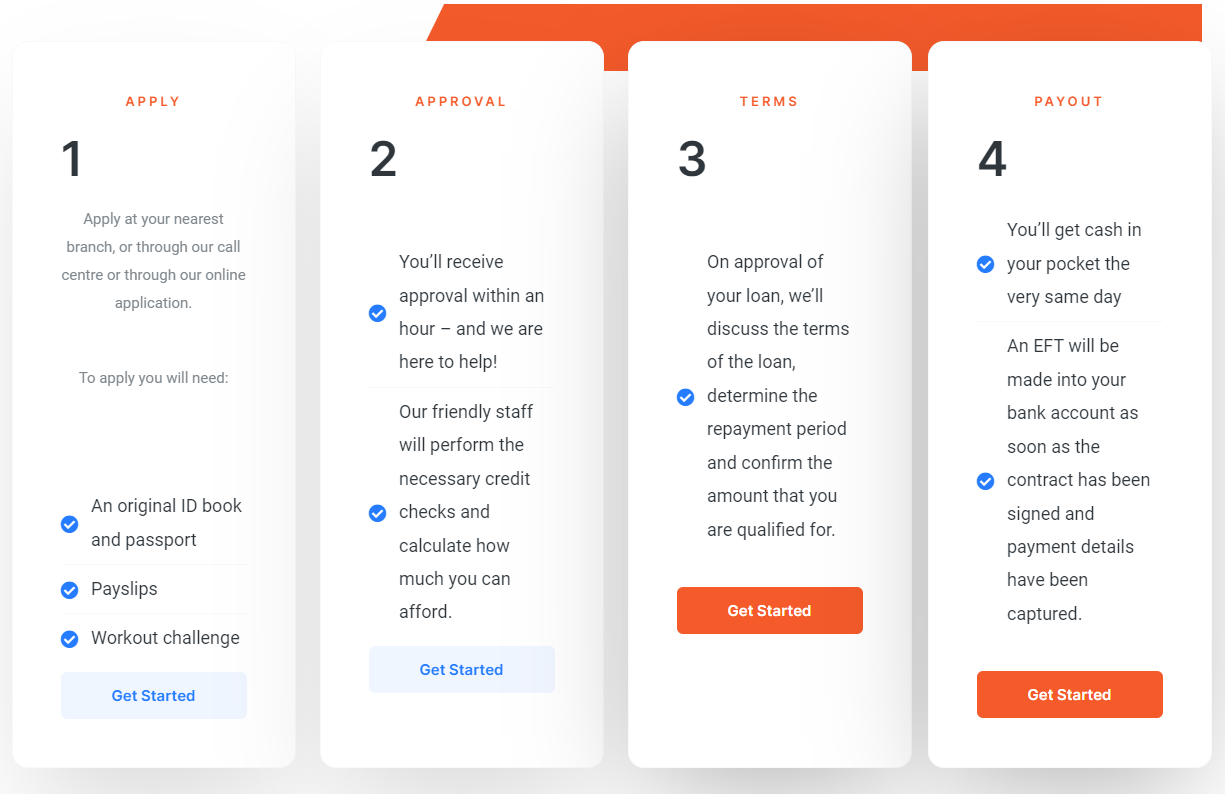

Under the How It Works section of the website Direct Access Finance requests that those looking for a loan provide a copy of their ID or passport, proof of salary and workout challenge. We’re not sure how a workout challenge relates to money lending but to us that’s another, obvious red flag.

We, like Standard Bank, urge our readers to stay away from Direct Access Finance. Aside from the red flags on the website, the lack of NCR registration is reason enough to avoid the entity. We also recommend our readers don’t visit the website or share any information with the entity as it’s not clear what the endgame is.

The NCR has rules in place that protect both lenders and consumers. These protections include setting the maximum interest rate and fees payable on a loan, ensuring that lenders follow the correct methods when collecting debt and making sure that borrowers know what they are signing up for.

You can check if a company is registered with the NCR by visiting the regulator’s website here.