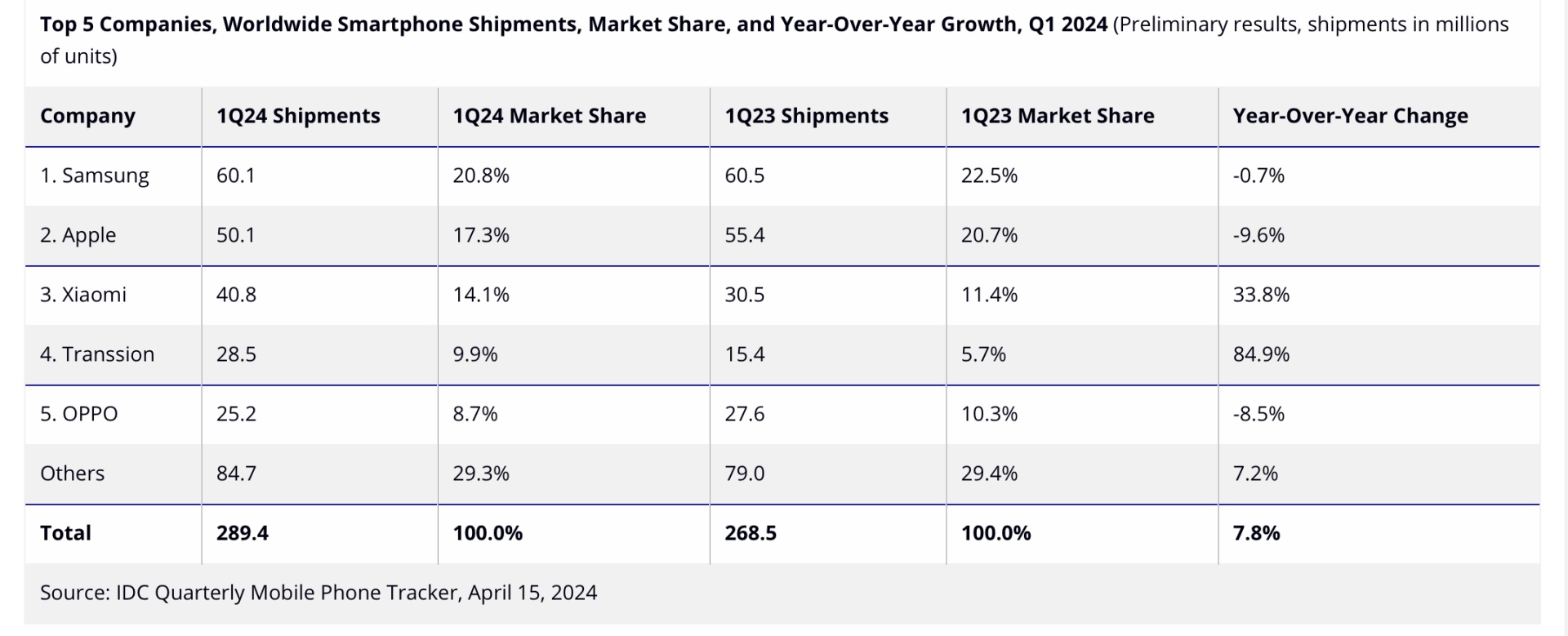

- IDC has released its smartphone shipments report for Q1 2024, which saw shipments rise by 7.8 percent year-on-year.

- Samsung secured the top spot, with Apple dropping to second.

- The Cupertino-based firm also shipped less devices in this quarter compared to last year.

Much has been made of the cost of smartphones these days, with the mid-range space holding more value than ever before as price savvy consumers get more discerning about where they spend their money. With that in mind, research firm IDC has released its latest phone shipments report looking at Q1 2024.

The phone shipments report is quite good news for the smartphone market in general, with it up 7.8 percent year-on-year to 289.4 million units for the first quarter of 2024.

It makes slightly worse reading for Apple, which saw it losing top spot to Samsung, as its iPhone shipments fell 9.6 percent year-on-year. It is the largest decline among the top five vendors in the IDC report, with OPPO next worse at a slip of 8.5 percent.

Unlike the Chinese phone maker, Apple’s results are a little more concerning as it recently launched its flagship iPhone 15 series, which went head-to-head with Samsung Galaxy AI sporting S24 series. It appears as if the introduction of on-device AI worked a treat for the South Korean outfit, although it should be highlighted that it did fall year-on-year by 0.7 percent.

“As expected, smartphone recovery continues to move forward with market optimism slowly building among the top brands. While Apple managed to capture the top spot at the end of 2023, Samsung successfully reasserted itself as the leading smartphone provider in the first quarter,” noted Ryan Reith, group vice president with IDC’s Worldwide Mobility and Consumer Device Trackers.

“While IDC expects these two companies to maintain their hold on the high end of the market, the resurgence of Huawei in China, as well as notable gains from Xiaomi, Transsion, OPPO/OnePlus, and vivo will likely have both OEMs looking for areas to expand and diversify. As the recovery progresses, we’re likely to see the top companies gain share as the smaller brands struggle for positioning,” he added in a release regarding the report.

With a number of Chinese phone makers looking to make a mark in South Africa in recent years, it will bode well for local consumers on the lookout for well specced and equally well priced options as things get increasingly competitive within the SA market.

“The smartphone market is emerging from the turbulence of the last two years both stronger and changed,” enthused Nabila Popal, research director with IDC’s Worldwide Tracker team.

“There is a shift in power among the Top 5 companies, which will likely continue as market players adjust their strategies in a post-recovery world. Xiaomi is coming back strong from the large declines experienced over the past two years and Transsion is becoming a stable presence in the Top 5 with aggressive growth in international markets. In contrast, while the Top 2 players both saw negative growth in the first quarter, it seems Samsung is in a stronger position overall than they were in recent quarters,” they unpacked.

We should therefore see the other top 5 vendors look to be more aggressive in terms of phone shipments over the coming quarters.

Should the prospect of an expensive flagship phone not prove appealing at the moment, we recommend checking out our latest Geeks Love Lists podcasts for six more affordable options in the link below.