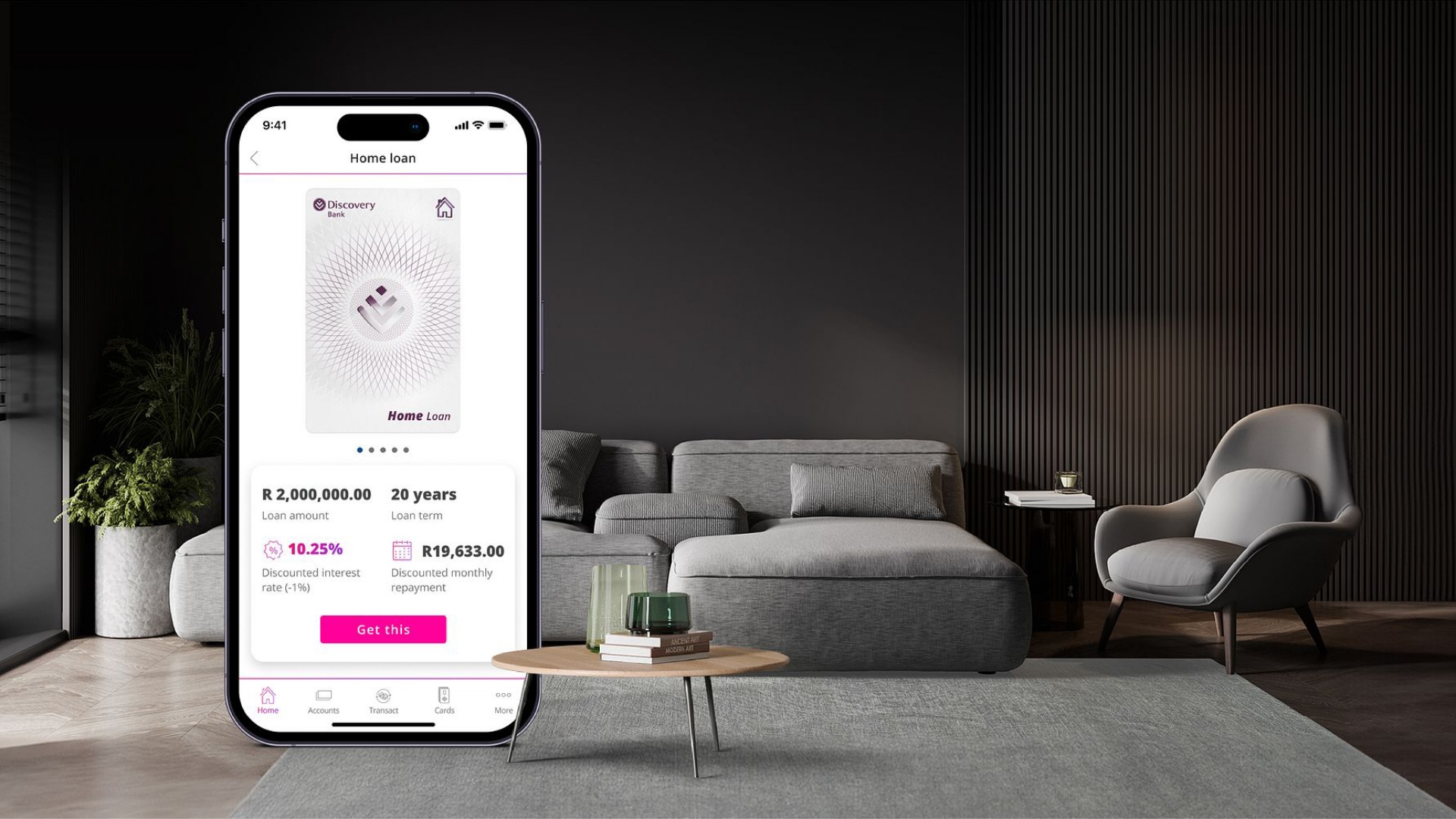

- Discovery Bank has launched a new home loan product that is built around its Shared-value Banking model.

- With the model, it allows customers to further reduce their interest rate by up to 1 percent.

- It says that the Discovery Bank client base could save up to R2.8 billion in interest repayments on their current loans.

Discover Bank has announced the launch of a new home loan product with a dynamic interest rate saving facility.

Here Discovery Bank says it will offer clients competitive, personalised rates based on their individual risk profiles, along with using its Shared-value Banking model to enable clients to further reduce their interest rate by up to 1 percent.

“This will be done by managing their money well with Vitality Money and protecting their home loan and home with the relevant insurance products Discovery offers,” it explained in a release with Hypertext.

“Clients can lock in a market-related rate upfront, and dynamically reduce interest repayments by managing their money well to save over the long term,” it added.

According to Discovery Bank this could save its client base up to R2.8 billion in interest repayments on their current loans, and with the same Shared-value Banking model, it predicts that South Africans could save up to R12.2 billion a year.

“This is a highly anticipated milestone for us as we open the virtual doors to our home loans ecosystem. Those looking to buy a new home or wanting to upgrade their home, can enjoy a full ecosystem of benefits and tailor-made services in the Discovery Bank app,” Hylton Kallner, CEO of Discovery Bank, highlighted.

“Our clients have comprehensive homeowner support alongside our home loans, with protection products for their homes and family, access to additional financing of energy solutions, and various rewards,” he added.

It looks like Discovery is once again leaning on the gamification model that it has with its healthcare offerings and other financial products, as the Bank is rewarding clients based on how they handle their money.

“The behaviours that are rewarded, include saving, being adequately insured, investing for retirements, and paying off home loans faster. The Bank shares the value from these financial behaviours back with clients in the form of better interest rates and other rewards linked to the Vitality Money programme,” the financial services provider pointed out.

“The better clients manage their money, the higher their Vitality Money status and the better their rewards. Through the combination of Vitality Money, the Home Loan Protector and Building and Contents Cover, Discovery Bank home loan clients with can lower their interest rates by up to 1%,” it continues.

Moving forward, all clients who take out new home loans, switch home loans, or refinance their homes with Discovery Bank can qualify for the Shared-value Interest Rate discount.