Videogames are one of the fastest growing sectors of South Africa’s economy, and the government should be supporting the sector better. That’s the view of analytics and consultancy firm pwc, which published its annual report into the South African Entertainment and Media industries today.

The firm is bullish about growth in digital spending across the continent.

According to pwc’s figures, by 2017 a massive 67% of South Africans will have a mobile data contract, against a global backdrop of 54%. This, the firm says, is going to fuel a massive rise in demand for online content, apps and games – and if traditional firms don’t adapt,

By comparison, the figures for fixed-line broadband access by 2017 are a projected 18% for South Africa against a global average of 51% of households.

While people are moving online in droves, however, they’re also becoming more cautious. Thanks to “high profile cases which have caused distrust” – ie PRISM – general consumers are becoming very aware of privacy concerns.

According to pwc’s Vicki Myburgh: “What is new is the increasing sensitivity around privacy and their expectation about what businesses are doing with their information.”

There’s a high expectation of a quid pro quo in return for the data they do surrender too.

“Customers are saying that ‘you know I like your product, you know I’m on your website, so give me something back like a voucher or a discount’,” Myburgh says, “But they do expect companies to protect their data when they hand it over.”

Myburgh’s advice to the digital industry is very commonsensical. Piracy is a problem, she says, but its not as serious as you might think.

“Piracy is a failure of business to provide a working digital model [to meet demand],” Myburgh says, “When there’s a streaming or download model that makes sense to them, consumers are willing to pay.”

Slow introduction of streaming services in South Africa has left the music industry reeling. According to pwc’s figures, the only thing preventing a decline in the industry’s value is increasing revenue from live events.

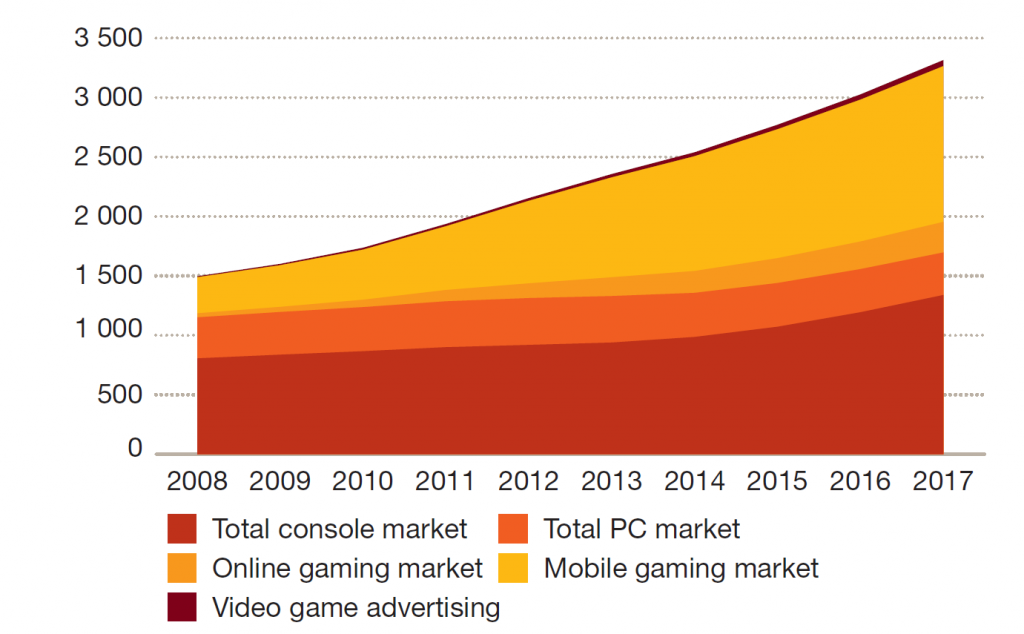

The fastest growing sector of the digital economy across Africa however, outside of internet usage itself, is gaming – and specifically mobile gaming. The market for videogames will increase by 20% in South Africa and 21% in Nigeria by 2017, and it’ll be almost entirely driven by ‘freemium’ games downloaded to mobile phones. Sadly, these will be mostly produced by overseas companies and distributed through the international app stores. There aren’t enough local games developers, says Myburgh.

“What we see in the film industry is a lot of government encouragement and subsidy, as a result of which South Africa is competing very well against the world,” Myburgh says, “Government should absolutely be doing the same thing for videogame developers.”

The report predicts that videogames will be a R3.3bn market by 2017, up from R2.1bn today – easily overtaking the value of the total market for music (R2.2bn by 2017) and that for film (R3.1bn). The value of mobile gaming will treble in size.

From government’s perspective, that makes a lot of sense. The amount of revenue earned by taxing in-game downloads through Google Play, for example, will be an awful lot less than the potential boost to the economy by having a large, well staffed games developer making international hits from Cape Town.

The report is yet another high profile publication equating internet access to increased consumer spending and higher quality of life. According to figures from the World Bank, a 10% increase in broadband penetration equates to a 1% increase in GDP, while another report published earlier this week suggests that faster broadband is directly correlated to increased household income.

(Table source: pwc)