- Last week the country reacted to its grey listing by the Financial Action Task Force (FATF).

- South Africa’s place on the grey list is as the result of its inability to prevent financial crimes.

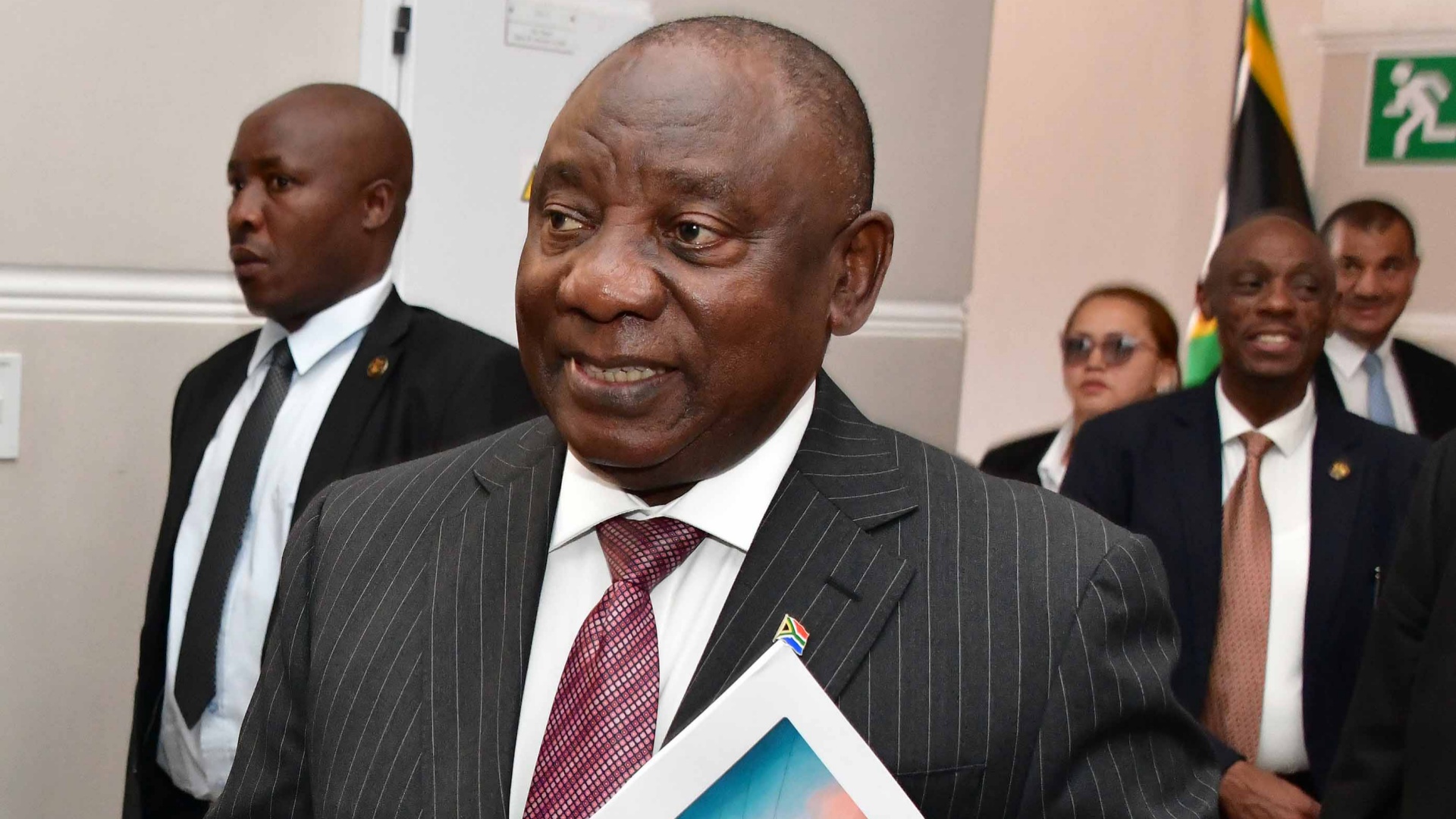

- In response President Cyril Ramaphosa has unpacked measures already taken to address this, while also trying to frame the grey listing more positively.

Last week was a particularly tough one for South Africans, as Stage 6 loadshedding continued unabated, and a grey listing for the country by the Financial Action Task Force (FATF) highlighted how rife financial crimes were locally.

Many reacted to the news, including President Cyril Ramaphosa, who shared his thoughts on the subject in his regular From the Desk of the President releases.

In it, he unpacked some of the points laid out by the FATF, and what steps have been taken to date to tackle specific issues. Added to this was purposeful reframing of some of the problems highlighted, with the president looking to paint a more positive picture of the situation.

In fact, he noted that the grey listing was a good thing, allowing South Africa the opportunity to focus on its objectives first agreed upon with the FTAF in 2021.

“As a country that both values and enforces the rule of law, the grey listing is an opportunity for us to tighten our controls and improve our response to organised crime. This will ultimately place us on a stronger footing to effectively fight these damaging and dangerous crimes,” wrote Ramaphosa.

Currently the South African government is working with the FTAF in order to meet the necessary goals when it comes to moving off of the grey list.

“Since the adoption of its MER in June 2021, South Africa has made significant progress on many of the MER’s recommended actions to improve its system including by developing national AML/CFT policies to address higher risks and newly amending the legal framework for TF and TFS, among others,” the organisation referenced in its report.

Ramaphosa makes specific mention of the framework outlined by the FATF, also taking the opportunity to note what has been done to date, likely as a move to quell rising concerns.

“Our action plan to address these deficiencies is aligned with the work we are doing to implement the recommendations of the State Capture Commission as outlined in our submission to Parliament in October last year,” he explained.

“We have restored credibility to key institutions like SARS and the NPA to enable them to fulfil their respective mandates. We have bolstered the powers of the Special Investigating Unit (SIU) by establishing a Special Tribunal to recover public funds stolen through corruption and fraud, and an Investigative Directorate in the NPA to investigate serious corruption,” he continued.

The president also made mentioned of last week’s Budget Speech, where it was shared that The Fusion Centre, established in 2020, and bringing together bodies like the NPA, SIU, SARS, Hawks, Crime Intelligence, State Security Agency and the FICm has recovered approximately R1.75 billion in criminal assets.

Ramaphosa was effusive in his praise of the local finance sector too.

“It is noteworthy that the strategic deficiencies identified by the FATF do not relate directly to the country’s financial sector. This means that financial stability and costs of doing business with South Africa will not be seriously impacted by the grey listing,” he emphasised.

While the president addresses many of the points outlined by the FATF, the crucially missing aspect is that of a timeline, timeframe, or indeed any kind of deadline to rectify the problems. Much like loadshedding, it remains to be seen how effectively this grey listing will be tackled.

[Image – CC BY-ND 2.0 GovernmentZA on Flickr]