- Crypto markets worldwide are showing early signs of recovery after months of decline.

- Bitcoin is now trading near levels it saw before the collapse of the FTX crypto exchange.

- Many other smaller tokens are also rallying as new regulations come into effect in the US.

After weathering several months of decline, cryptocurrency is starting to show signs that the dreaded “crypto winter” is ending.

According to a report from Reuters, crypto markets have begun to shift in favour of many of the largest tokens as of Friday, with international regulations and investments now moving in a positive direction for the decentralised, digital money for a change.

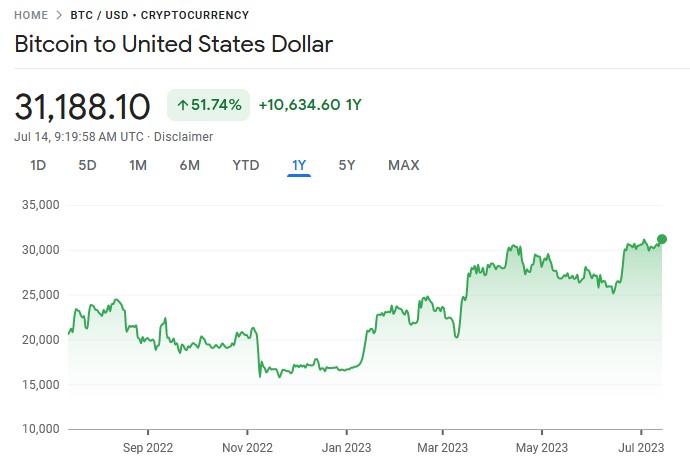

Bitcoin, the most important crypto token, was trading at its highest price since June 2022, touching $31 818 as of Friday morning, it has fallen slightly since then but remains at the $31 000 mark.

Data from Google Finance shows how Bitcoin has gradually moved from its sub-$20 000 mark to above $30 000, meaning that the token is sitting around its year-strongest as of the time of writing.

Second-most important, Ether, is seeing some of its best trading performance since March, and XRP token soared 73 percent after a US judge ruled that it could be legally sold on public crypto exchanges like Luno or Binance.

However, XRP is still small compared to the likes of Bitcoin and Ether, and even its latest rocketing only places it at around R14 to 1 XRP. However, the fresh tailwinds of XRP rallied other smaller tokens like Solana, Matic and Stellar, with some of these seeing price increases between 15 percent up to 50 percent.

Many crypto assets are now trading near or above levels seen before the public collapse of the FTX exchange and the arrest of its CEO Sam Bankman-Freid.

The winter brought about by the collapse of FTX and factors such as stricter regulation worldwide, and an outright ban in China, saw the collapse of peripheral markets such as NFTs which have lost almost all of their 2021 shine.

However, South Africans are still interested in crypto and are watching the bigger coins. In May, locally operating exchange Luno said that customer engagement was increasing despite cooler markets with as many as 250 000 people trading on its app weekly.

At the time Christo de Wit, Luno’s country manager, said that Luno was seeing “consistently higher trading volumes in South Africa, which give us the confidence that the crypto market is still very active – even when markets contract.”

Regulations in the South African market have arrived, and punishments for violators are harsh – fines of up to R10 million. Locally operating exchanges like Luno, Binance and Yellow Card have until 30th November 2023 to register with the Financial Sector Conduct Authority (FSCA) or face the consequences.

[Image – Photo by Thought Catalog on Unsplash]